You’d think that invoice management would be simple. After all, it’s just making payments to suppliers and receiving payments from clients. In fact, there’s more to invoice management than that. It involves data entry, communicating with different people on your team, checking for errors, validating bills, and more.

Unfortunately, this tedious task is essential even for everyone — from the largest corporations down to entrepreneurs. It’s the only way to ensure that you make and receive payments of the right amount at the right time.

But invoice management doesn’t need to be a headache. These invoice management best practices will help you streamline the process.

1. Learn Key Terms

Invoice management can be confusing and even frustrating if you come across financial terms you don’t understand. It’s worthwhile familiarizing yourself with a few key terms before you get started:

- Accounts payable — Also AP, this may refer to the account in your business ledger that you use to record payments to suppliers or the department in the company that handles these payments.

- Accounts receivable — Also AR, this is the account in your business ledger where you record the payments you are waiting to receive.

- Audit trail — Written records around the transaction, usually for verifying accuracy.

- Itemized — When an invoice is itemized, it specifies the different products or services being paid for. Each product or service that appears on its own line is called a line item.

- Net followed by a number — The number that follows expresses when the net payment amount is due. This could be a date or a number like 30 (in which case, the payment is due in 30 days). Net0 means the payment is due that day, although you may see “on receipt” instead.

- Optical character recognition (OCR) — The technology automated invoice management tools use to recognize text.

- Recurring invoice — Invoices you send or receive on a regular basis, always for the same amount.

2. Stop Doing Manual Invoice Processing

Paying invoices is especially time consuming when you use a manual process. By manual invoice processing, we don’t mean printing out digital invoices before entering the data into spreadsheets (some people really do this). Manual processing refers to the process of dealing with data entry, emailing back and forth, and authorizing payments.

The manual invoice management process goes like:

- Send the invoice to the right person. The invoice will probably have reached your supplier’s point of contact, but this is not necessarily the person responsible for finances at your company.

- Deal with any issues. You’ll need to resolve any problems with the invoice before you can make the payment.

- Process the invoice. You need to enter the data into a spreadsheet, then confirm the legitimacy of the bill, next make the payment, and finally add the details to your accounting ledger.

You can eliminate much of this process through digital invoicing. Whoever receives the invoice — even if it’s not your financial team — inputs the data into an invoice management system. Alternatively, you can use a system that automatically extracts data from invoices or one where your suppliers add payment requests directly to the system, rather than sending you raw data.

With a digital system, the person in charge of handling payments will receive a notification and can check the invoice before approving or denying the payment. If someone else is responsible for making the payment, this person will receive a subsequent notification. The invoicing app then sends the data to your accounting tool.

By using a digital system, you reduce data entry to a maximum of one instance (zero if you use an automated tool or if the supplier inputs data). Plus, there’s no need to email your team members.

3. Use Invoice Management Tools

You’ll need to find the right invoice management app for you. There’s a wide variety to choose from, but the following are some of the best.

Spendesk

With Spendesk, anyone with permission can upload invoices. The software will log all your payments and specify who approved them. An additional feature is real-time budget management, which can help you allocate your funds to the right places.

SAP Concur

For travel and other expenses as well as invoice management, a top option is SAP Concur. The invoice management software uses machine learning to capture invoices along with has two- and three-way to avoid errors and resolve discrepancies.

OpusCapita

If you’re mostly receiving invoices from suppliers, OpusCapita is a top choice. Suppliers can submit their invoice straight to the tool, meaning there’s no data entry or emails necessary. In fact, all you need to do is verify the invoice and accept the payment.

Bill.com

When you’re paying suppliers and receiving payments from clients, you need both accounts payable and accounts receivable. Bill.com allows you to combine the two through the same platform. Other great features include approval workflows and a place to store contractors’ information.

Stampli

For automation and integration with your accounting tool, use Stampli. The software uses OCR technology combined with artificial intelligence and machine learning. You can also use your preferred payment method, including ACH transactions. Add various team members to the software by setting the roles and permissions you want. This will help you streamline the process without putting your financial data at risk.

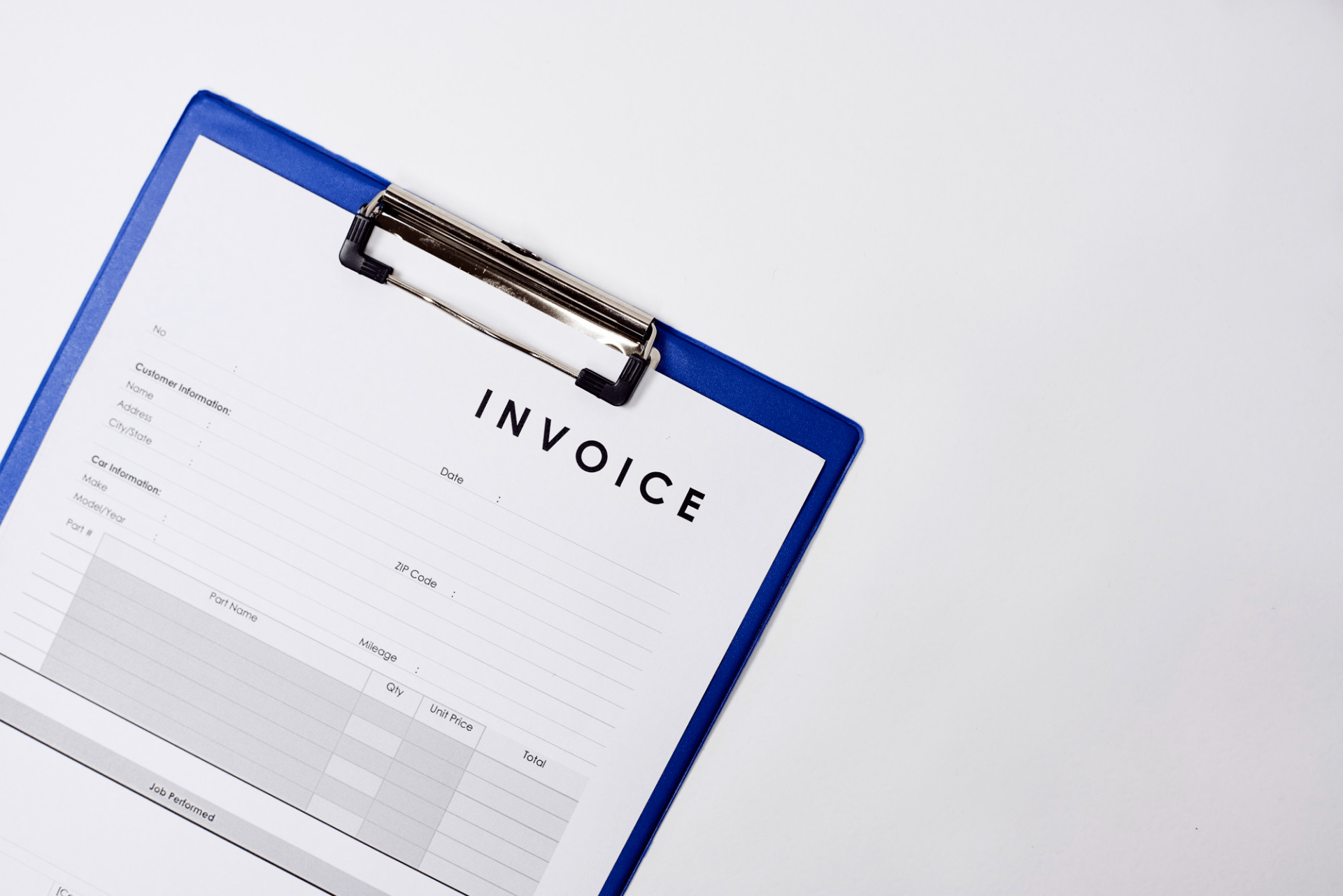

4. Send Professional Invoices

Even invoices contribute toward your branding. A proper invoice is much better than just sending an email requesting payment. In fact, it’s essential to send out professional-looking invoices to show clients that you have a credible business and that they can trust you with their payment details. Your best option is to customize an invoice template with your company information. Just make sure you do include everything clients need to make a payment.

Another way to ensure your invoices look professional is to itemize them. Rather than requesting the total amount, list everything individually. This will show clients exactly what they’re paying for to prevent confusion and disputes. It will also help you to receive payments faster.

5. Outsource Invoicing to a Virtual Assistant

Even when you use software that offers the maximum automation capabilities, there are some manual tasks to complete. For example, you still need to send nonrecurring invoices, check those you receive for accuracy, and make payments.

Large businesses have a dedicated accounts payable team. Entrepreneurs and small businesses, though, cannot afford such luxuries. It is also unnecessary — the likelihood is you don’t have nearly enough invoices to make even one full-time staff member necessary.

Nonetheless, this doesn’t mean you can’t delegate invoicing to someone else. A top choice is a virtual assistant who specializes in financial tasks. This will free up you and the rest of your team for other work. Better still, having someone dedicated to invoices minimizes the risk of errors.

6. Create an Invoice Policy

No one likes surprises on invoices. You, your clients, and your suppliers all need to be on the same page. Before agreeing to any purchases, make sure both parties are clear about price, payment method, and payment schedule. Plus, if you’re using a payment method that incurs a cost, specify who will pay these fees.

7. Have a Strategy in Place for Overdue Invoices

Even if you have an excellent invoice system in place and work with clients you trust, there’s always the chance you may need to deal with an occasional overdue payment. By having a strategy in place, you can improve the chances you receive payment as soon as possible.

Begin with a series of emails that request payment. Sometimes, your client may just have forgotten to pay you or the original invoice may have ended up in junk mail. Decide how many emails you’ll include in the sequence and on the frequency you’ll send them. Also determine when the client will start accruing interest on a late payment — be sure to communicate this with clients when discussing invoice policy.

There’s always a risk that a client will end up failing to pay you entirely. Familiarize yourself with the legal action you can take in such situations to prepare in advance for this possibility.

8. Monitor Your Cash Flow

You also need to make sure that you’ll be able to pay the invoices you receive on time. This means knowing your cash flow situation and ensuring you have sufficient funds when a payment comes due. In addition, monitoring your cash flow is important for helping you plan your expenses around when clients pay you — and for preparing for times when someone pays you late.

Invoice management will take time whatever you do, but there are ways to make it less stressful. Using a digital, rather than a manual, system is essential and outsourcing support from a virtual assistant is beneficial even if you have just a one-person startup. Lastly, having a policy in place and writing up a sequence of emails for late payments will save time when dealing with problems in the future.

Outsource your invoice management to MYVA360. Our virtual assistants for entrepreneurs can also help you with other financial management tasks, along with routine activities that take up too much of your time. Schedule a consultation for more information.